We judge overheating of the market (overbought and oversold) against the whole fluctuation range.

Relative Strength Index (RSI) is a trading method of so-called “contrarian” (buy when price goes down and sell when price goes up), so it is effective for range markets.

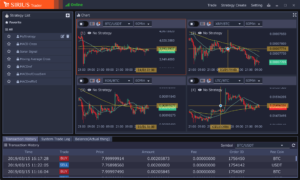

Sirius Future’s Chart

Relative Strength Index (RSI) is a conservative quote, selling up when it goes up and buying it down.

Buy Signal

・ When RSI, which has been below 30%, has risen above 30%

・ Busy divergence: When prices have fallen and renewed lows, but RSI has not fallen below lows

・ Failer Swings: Uptrend Rebounds immediately after RSI drops below 40%

Sell Signal

・ When RSI, which had been at 70% or more, has fallen below 70%

・ Bare Bearish: Price has risen and updated to a high price, but RSI has not exceeded the high price

・ Fairer Swings: A downtrend When it falls immediately after RSI rises to more than 60%

Virtual currency system trading ・ automatic trading tool

Sirius Trader(Spot・Futures)

Create strategies within candlestick charts, compare the performance of multiple strategies through back testing, select the most effective and begin trading.

Download Now

AD.

Leave a Reply