Designed by Donald Lambert to discover cyclicality in the commodity market.

In the commodity market, we make decisions on overbought and oversold and the timing of buying and selling on the assumption that highs and lows are repeated in a certain cycle.

Generally, it is recommended to use 1/3 of this cycle completion period for CCI.

How to read CCI:

CCI tends to be overpriced above levels of +100 because it is overbought, and tends to be below levels below -100 because it is oversold.

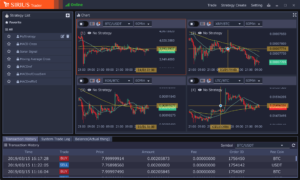

Sirius Future’s Chart

Buy Signal

① CCI below -100 is higher than -100

② CCI breaks out of the signal below -100

Sell Signal

① When the CCI that was above +100 is lower than +100

② When the CCI falls below the signal at a level exceeding +100.

Virtual currency system trading ・ automatic trading tool

Sirius Trader(Spot・Futures)

Create strategies within candlestick charts, compare the performance of multiple strategies through back testing, select the most effective and begin trading.

Download Now

AD.

Leave a Reply